From the Zerohedge article:

“It’s A Huge Story”: China Launching “Petroyuan” In Two Months

If China or Russia or both ever start to dismantle America’s hegemonic control of the sale of oil, which for generations has been almost exclusively traded in US Dollars – the America’s economy will tank.

The Petrodollar – the US Army-backed (we destroy those who try to opt out of this) system has made nations hoard trillions of dollars as their reserve currency of choice, instead of exchanging it for “stuff” – goods and services. What will happen to the purchasing power of dollars, when nations no longer need to hold so many trillions in reserve, and they start to suddenly exchange them for “stuff” in great quantities? Obviously, based on supply and demand, the cost of stuff will riise, and the value of dollars will fall. Probably by more than 50%

“The World Bank’s former chief economist wants to replace the US dollar with a single global super-currency, saying it will create a more stable global financial system.

“The dominance of the greenback is the root cause of global financial and economic crises,” Justin Yifu Lin told Bruegel, a Brussels-based policy-research think tank.“The solution to this is to replace the national currency with a global currency.”

The writing is on the wall for dollar hegemony.

As Russian President Vladimir Putin said almost two months ago during the BRICs summit in Xiamen,

“Russia shares the BRICS countries’ concerns over the unfairness of the global financial and economic architecture, which does not give due regard to the growing weight of the emerging economies. We are ready to work together with our partners to promote international financial regulation reforms and to overcome the excessive domination of the limited number of reserve currencies.”

As Pepe Escobar recently noted, ‘to overcome the excessive domination of the limited number of reserve currencies’ is the politest way of stating what the BRICS have been discussing for years now; how to bypass the US dollar, as well as the petrodollar.

Beijing is ready to step up the game. Soon China will launch a crude oil futures contract priced in yuan. This means that Russia – as well as Iran, the other key node of Eurasia integration – may bypass US sanctions by trading energy in their own currencies, or in yuan. Inbuilt in the move is a true Chinese win-win; the yuan – according to some – will be fully convertible into gold on both the Shanghai and Hong Kong exchanges.

The new triad of oil, yuan and gold is actually a win-win-win. No problem at all if energy providers prefer to be paid in physical gold instead of yuan. The key message is the US dollar being bypassed.”

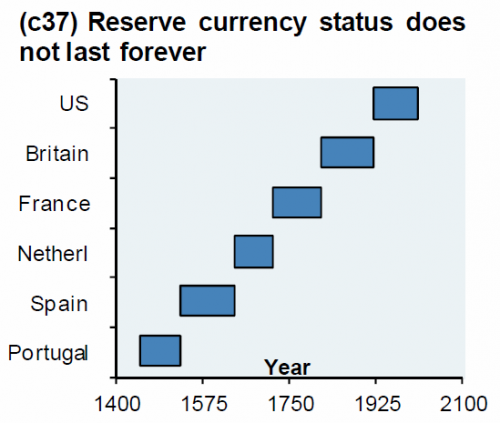

When the dollar loses reserve status, it will crush the US Economy. Americans will wish a comparison could be made to Britain’s Pound losing reserve status to the dollar. The British “lost out” to their closest ally, and the two allied nations then operated with a virtually united monetary policy. America will lose reserve status to rising potential enemies like China… and it will be time to pay the piper for accumulating massive debts, spending the future now for over 70 years…

I know I sound like a broken record, but recession depression economic collapse and WWIII are not so far away…