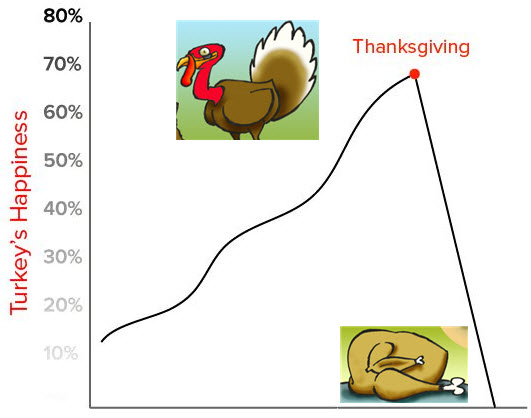

This is not so different from the “irrational exuberance” Alan Greenspan once spoke of or the way almost everyone with two extra nickels was investing in the stock market just before October 1929’s epic crash. The turkey liked feed corn and didn’t ask questions. Investors today like when profits occur with minimal research effort. Do most investors understand how precarious today’s status quo really is? Is the risk really understood? Do you suffer from “normalcy bias” – extrapolating stability you have known forever into the future, instead of understanding that the longer things have stayed one way (stable progress) the MORE overdue we are for a change and the MORE likely collapse becomes compared to never-ending good times?

And when the next major crash inevitably begins, will you be ready to acknowledge it for what it is – or will your greed blind you into denial?

As a recent Vanguard Study suggests: after the first stage of deciding to invest, in stage two “an investor grows over-confident about his investment decision. He also thinks too much about recent positive results, failing to take long-term information into account.” In stage three “these market participants suffer from two conditions. The first is group-think, whereby they begin to feel invulnerable and rationalise their behaviour and also to ignore contradictory information. The second problem is that groups tend to make riskier decisions than individuals make on their own…. The final act represents the come-uppance phase. Here, investors become realists as the worth of their investments tumbles. “At some point, observed data becomes so overwhelming as to call into question the excessively optimistic forecasts of market participants,” according to Vanguard’s research.

Guess what, investors: we are well into that stage.

[youtube https://www.youtube.com/watch?v=S8Mmphb5x9s&w=854&h=480]

If economic collapse does come soon – are you prepared? Are you financially diversified? Are you a prepper? Are you mentally or spiritually ready for very hard times?

You know what I expect from my articles and my books. What do you see in 2017?