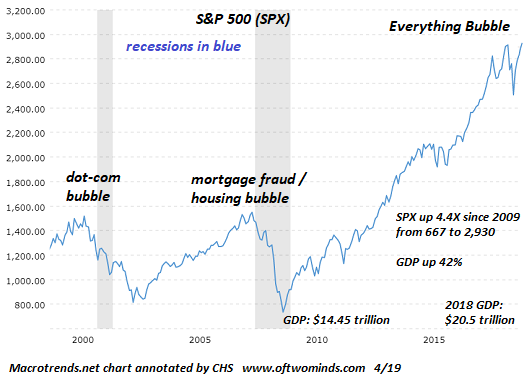

“Does anyone really think The Everything Bubble can just keep inflating forever? What do I mean by a profoundly shattering recession? I mean, a systemic, crushing recession that can’t be reversed with central bank magic, a recession that only deepens with time. The last real recession was roughly two generations ago in 1981; younger generations have no experience of a profound recession, and perhaps older folks have forgotten the shock, angst and bitterness. A profoundly shattering recession leaves tremendous damage and pain in its wake. Millions of people who reckoned their position was secure get laid off, businesses that looked solid melt into air, large corporations flip from hiring thousands to firing thousands, and everyone on the edge of insolvency gets a hard push over the cliff.”

“Profoundly shattering recessions feed on themselves in a self-reinforcing dynamic: the first domino could be a supply-shock, or a decline in demand due to credit exhaustion. Since businesses have cut everything to the bone in the past decade, there are no buffers left: layoffs begin immediately, and those layoffs further reduce demand as households have to tighten their belts to survive as even those who escape the first round of layoffs find bonuses and overtime have been slashed.

Since the problem isn’t high interest rates, central banks reducing rates or pushing them into negative territory only reveals their impotence. If negative interest rates boosted the real economy, Europe and Japan would be experiencing rapid expansion instead of stagnation.

Layoffs, the failure of central banks and soaring fiscal deficits trigger a drop in consumer and investor sentiment which feeds back into declining sales and profits, which then trigger more layoffs as businesses must cut expenses as revenues crater.

Clearly, there is no benefit to households or enterprises to this self-reinforcing recession. The benefits are structural: financialization, the parasite that has eaten our economy from the inside, will collapse along with the mountains of debt that fueled it.

Zombie corporations and local governments that have been insolvent in all but name will finally go bankrupt, clearing the system of their dead weight. Economies supporting zombie entities are sacrificing their capital to keep insiders afloat, which leaves less capital to invest in increasing productivity, which is the only way to increase broad-based wealth.

The Everything Bubble will finally pop, stripping the system of phantom speculative wealth and fictitious capital. Price discovery will once again be possible, as all the central bank-inflated bubbles will deflate and real demand and supply will set the price of assets.

Once central banks have been revealed as powerless, the quasi-religious belief in their omnipotence will dissipate, and people will finally start dealing with the Gilded Age excesses of the past 20 years. Common sense limits on financial predation and trickery will gather support, and tricks like corporate buybacks will be outlawed or restricted.

If capital can’t earn a low-risk return, then it can’t flow to productive uses.Once central bank manipulation fails, capital might demand a yield, and in doing so, it will start a beneficial cycle in which speculation will no longer be enabled and rewarded by zero-interest rates or negative rates.

Only those enterprises and households with productive uses for borrowed capital will reckon the interest costs are worth the risk of taking on debt. The bloated, parasitic banking sector will implode, and what’s left of it will return to its proper role, a thin, regulated sector of the economy stripped of political power.

All the cartels and monopolies that depend on debt will implode: banking, higher education, and ultimately national defense and sickcare, which depend on federal borrowing to fund their predatory pricing.

The U.S. economy needs a re-set if it is to lift all boats, and the sooner the re-set occurs, the sooner we can dispense with all the cronyist intervention, self-serving manipulation and exploitive distortion that’s turned our economy and society into a speculative casino that only benefits a few insiders and those who know how to rig the game in their favor.

A profoundly shattering recession requires patience, fortitude and an awareness that the sacrifices demanded will be worth the pain if we rid our society of at least the top layer of financial and political parasites and predators that have corrupted our economy, our governance and our society.

Does anyone really think The Everything Bubble can just keep inflating forever? Surely nobody’s that deluded.”

* * * * *

And while all of those side effects and corrections WILL benefit everyone in the long run, in the short run there will be a lot of fear and pain and people will be looking for someone to blame – and that is how dictatorships and war grow out of control. The likelihood of economic collapse is just one reason I still think

Nostradamus was right about WWIII being OVER by 2028.

About Author